August Market Update

Written by Ronald Pratap

A slowdown in manufacturing and continuing weakness in many emerging economies, as well as in Germany, has startled financial markets as we can see by the drop off in the first half of August. An escalation of the economic “cold war” between the US and China has threatened to derail global growth and affects markets globally. President Trump’s imposition and subsequent delay of additional rounds of tariffs has also been met with increasing nervousness.

More than 20%, or US$11 trillion worth, of bonds on issue worldwide are currently trading at negative yields. While we have not yet reached that point in Australia, interest rates are at record lows after the RBA’s recent back-to- back cuts. Indeed, when it comes to rates, we are in uncharted territory, with the view currently prevailing that rates are unlikely to return to normalised levels any time soon. Rather, we appear to be firmly in a ‘lower for longer’ environment. This presents a significant challenge for investors– and not just for those seeking income as we have seen all asset classes take a hit over the last 12 months. We continue to emphasis a well diversified portfolio of holdings of assets across different sectors and industries for those long term investors.

While the environment is challenging, the positive news is that there are still investment options available that can provide both income and growth, as well as investments that have the potential to outperform traditional benchmarks without the drain of high fees.

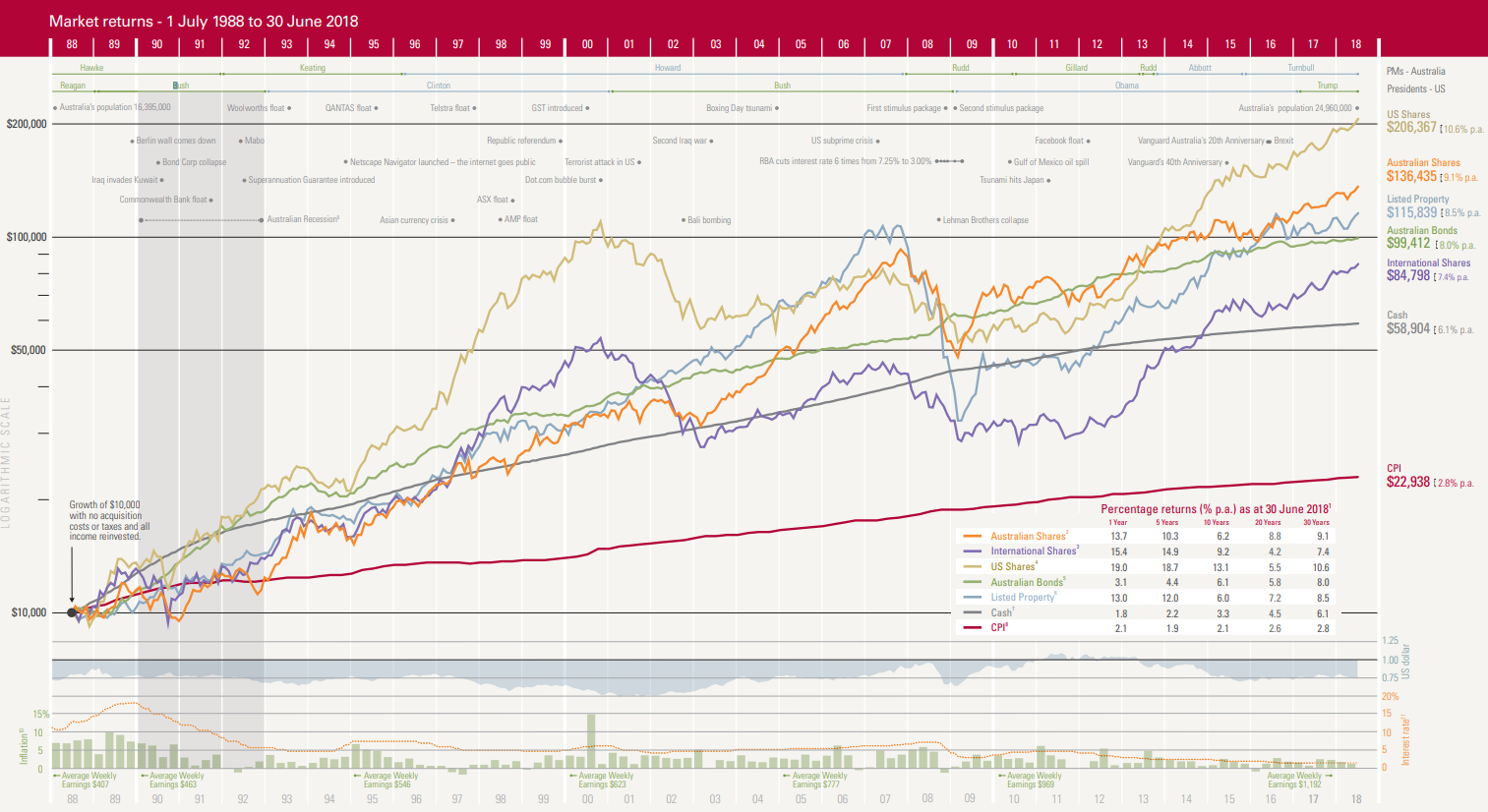

The table below shows investor placing $10,000 into the market in 1988 and the affects over time that several asset classes will have on the funds. We can see that over time growth assets continue to be the best performer with more volatility in short term periods,however these tend to be more smoother over time. We focus on building clients portfolios with a weighting across several asset classes depending on their risk profile.

With key economies losing momentum, the market panicked when the US 10 year treasury yield briefly moved below that of its 2 year equivalent. This was reported in the media as an “inverted yield curve” . This has made headlines because it has in previous cases come before a recession. At present, however, the yield curve is not inverted across these maturities.

At the time of writing this update, the market seems to have bounced back and regained some of the losses from the big drop off last week. This does not mean that things are over as there is much happening in global markets.

While we do not ignore the fact that risks to important global economies are mounting, it is worth emphasising that a recession is not currently the most likely outcome and that many data points are continuing to hold up well. The global consumer, and the US consumer in particular, is continuing to spend. The cost of borrowing is stable or decreasing. Investment is fixed assets remains solid in many regions and labour markets are continuing to create jobs along with gradual wage growth. In Australia, lower interest rates, the implementation of tax cuts, looser macro prudential settings and a rising infrastructure spend should benefit growth in the latter part of this year.

The sell-off in early August came soon after markets reached record highs. Given that there are ordinarily three or four sell-offs over the course of a year, this one is not altogether unexpected and shouldn’t be any more alarming. Forging a new high (or low) typically tests the market psyche and large swings often follow.

Problems usually arise when markets continue to fall and fear starts to grip investors – such as during the December quarter last year. But, as we noted in a previous communication in that period “the October sell-off could prove to be a buying opportunity.” Indeed, it is quite possible that the bumpy ride in August will also be well navigated by the broader market.

Why might that be the case?

In summary, one would expect that more volatility is on the way. There looks to be no short term resolution to the trade war and it looks unlikely as the US approaches another presidential-election year. Brexit, if and when it finally occurs, will create headlines, particularly if no deal can be reached with Europe. And Hong Kong, an important global financial centre, is being crippled by anti-China, pro-freedom protests. Signs of a military build-up by the Chinese near the Hong Kong border will also unsettle investors. Some see accommodative policy by central banks as encouraging a misapplication of capital, meaning that markets have further to fall should something go seriously awry.

On balance, we feel that equity investors are being rewarded for risk and that low interest rates (or discount rates) are helping justify elevated share markets. Holding a well-diversified portfolio can help buttress against market gyrations and make buying the dip a little less nerve-wracking. For investors with a long-term horizon, patience is a virtue as markets have shown a tendency to rise over the long-term.

As always please contact us if you would like to review your portfolio or have a discussion about the asset allocation of your funds.

Information contained within this update has been prepared as general advice only as it does not take into account any person’s investment objectives, financial situation or particular needs. The update is not intended to represent or be a substitute for specific financial, taxation or investment advice and should not be relied upon as such. Should you wish to obtain tailored advice, we recommend you speak with an Authorised professional or Financial Adviser.

Ronald Pratap

Get in touch with us to develop your strategic plan and achieve peace of mind.

-

ABN: 34 612 655 142