December Monthly Market Research Update

Written by Ronald Pratap

Emergence of Omicron

Just as we were learning to live with the Delta variant, a new variant of the COVID-19 virus has emerged and fears around the potential health and economic impacts of the B.1.1.529 variant of COVID-19, also known as Omicron, accelerated on Friday and over the weekend. The World Health Organisation (WHO) has classified Omicron as a ‘variant of concern’ and is monitoring developments closely.

Scientists around the world are moving rapidly to develop their understanding of this new variant and assess how it compares to others regarding infectiousness, serious illness and death, and vaccine resistance. However, it may take several weeks to fully understand the new variant and its potential implications for managing the pandemic, both domestically and globally. Uncertainty and volatility in financial markets could reign supreme during this time.

First discovered in South Africa, it has now been detected in several African and European countries, in addition to countries within our region. Numerous countries, including Australia, have reimposed travel restrictions for certain regions, and Israel has even closed its borders. Several cases have been confirmed in Australia, however, so far, they are limited to recently arrived travellers in hotel or other quarantine facilities. The Prime Minister will call a meeting of National Cabinet, including state and territory Premiers and Chief Ministers, to discuss how Australia will respond to the new variant.

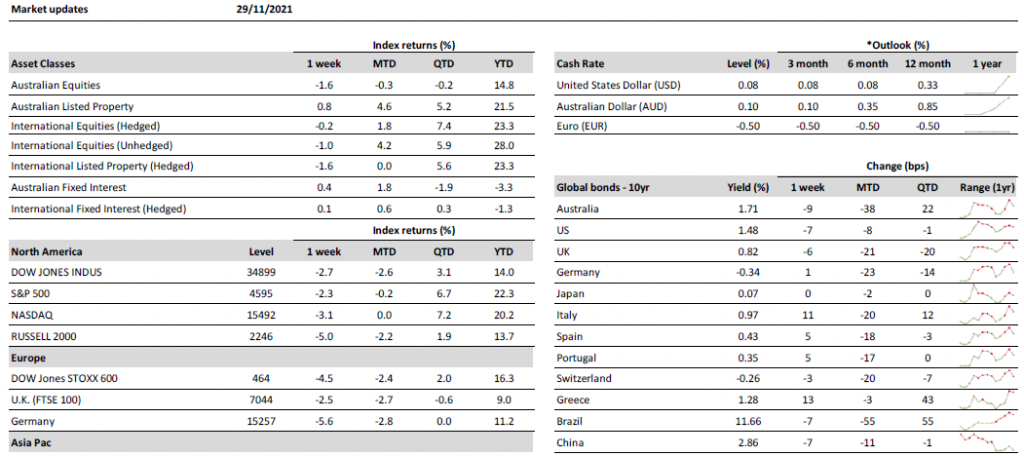

Financial markets were shaken by the news. Volatility spiked and risk-sensitive assets fell, while investors sought safety in safe-haven assets. Indeed, the VIX volatility index surged 10 points to its highest level since February. And there were large falls in global equity markets and bond yields.

The emergence of the new variant has the potential to dent the economic recovery across Australia and the globe. The rapid increase in vaccinations in developed countries has meant that, generally, the incidence of serious illnesses, hospitalisations and deaths have not spiked dramatically. This is despite an increase in cases as economies have emerged from lockdowns. However, over recent weeks, countries in Europe have reimposed various restrictions, including lockdowns, to deal with an escalation of cases in the region.

Australia’s rapid increase in the proportion of people that are fully vaccinated has allowed much of the economy to reopen as we learn to live with the virus. However, vaccination rates in developing countries remain low and case numbers high.

A tail risk to the economic recovery would be if Omicron proves to be resistant to the currently available vaccines, potentially in addition to causing more serious illness and/or being more contagious. This could lead to a resumption of the use of movement restrictions or lockdowns to manage the spread of the variant while new vaccines are developed. Such a development would negatively impact consumer spending and activity in the domestic and global economic recovery.

However, it is important to note that it is still early days. This outcome is far from a foregone conclusion. Scientists are investigating the new variant closely and we will be learning more over coming days and weeks. Omicron and its potential health and economic implications will remain a key development to monitor.

Economic Data

There is a flurry of economic data coming out this week. While markets and economists will be digesting the potential implications of the Omicron variant, we will also receive data to assess the economic impact of the Delta lockdowns over the September quarter.

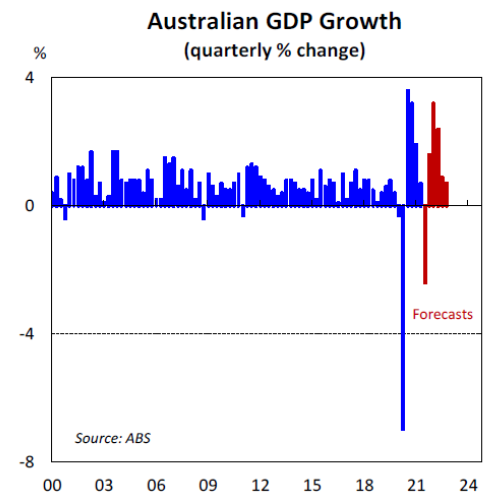

The highlight of the data releases will be September quarter GDP numbers, due on Wednesday. The release is expected to show a sharp contraction in GDP over the September quarter as the two largest states were heavily impacted by lockdowns. NSW was in lockdown for the entire quarter, while Victoria and the ACT were also impacted by lockdowns for part of the quarter. Partial indicators have suggested that the shock to the economy is likely to be less severe than initially feared.

We expect the economy to have contracted by around 2.5% over the quarter. The decline will be led by a large drop in consumer spending of 5.5%. Consumer spending makes up more than half of GDP and is a major driver of growth. A 2.5% decline would be the second largest quarterly decline on record, following the 7.0% plunge in the June quarter of 2020.

Prior to the publication of GDP numbers, additional partial information has been published today and more will be forthcoming tomorrow.

Data released earlier today showed that company profits rose by 4.0% over the September quarter. While Delta lockdowns negatively impacted company revenues, this was more than offset by increases in government subsidies to businesses. Company inventories fell by 1.8% in the quarter, as stocks were run down during lockdowns. Restocking was muted due to the shock to supply.

Tomorrow, balance of payments data is expected to show that the external sector of the Australian economy contributed around 1.2 percentage points to GDP growth in the September quarter. This partly reflects a strong bounce back in exports, following a weak outcome in the June quarter, as maintenance and weather-related disruptions negatively impacted exports in that quarter. Imports are also expected to have been negatively impacted by reduced demand following the Delta lockdowns.

Additionally, the record run of current account surpluses should continue in the September quarter. We expect an expansion of $10.5 billion in the current account surplus to a fresh record of $31.0 billion surplus. Such a result would mark the 10th consecutive quarterly current account surplus.

On the housing front, October building approvals data will be released on Tuesday. We anticipate a 4.0% decline over the month. The detailed information is expected to show a continued decline in approvals for detached houses, as the bring-forward effect induced by the Federal Government’s HomeBuilder scheme continues to unwind.

On Wednesday, CoreLogic data will show that dwelling prices continued to accelerate at a brisk pace in November. We predict dwelling prices rose by 1.1% over the month. This result would remain well-above the decade average of around 0.4% per month. While price growth continues to be robust, it has gradually slowed since the monthly growth rate peak in March 2021. In fact, over recent months, price growth has slowed from 1.6% in July to 1.4% in October. Affordability constraints continue to impact marginal borrowers. Fixed home loan rates have risen on average across authorised deposit-taking institutions (ADIs) and macroprudential tightening has started. Auction clearance rates remain elevated but have dropped from over 83% in early October to around 71% across the capital cities.

Continuing the housing theme, Thursday will see the publication of October housing finance approvals. Approvals are estimated to bounce back by 4.0% over the month, following a 1.4% decline in September. The September decline was driven by fall in lending to Victorians. In fact, excluding Victoria, lending would have risen in the month. A rebound in lending to Delta-affected states is expected to drive the bounce in October.

Thursday will also see the publication of trade data for the month of October. This is expected to show a continued slide in the value of the trade surplus, as the rapid decline in the iron ore price impacts the value of commodity exports. Additionally, recovering activity following the lifting of lockdowns across NSW, Victoria and the ACT should see an increase in imports over the month. As a result, we anticipate the surplus to decline to $10.8 billion, after a surplus of $12.2 billion in September.

Rounding out the huge number of data releases this week is private sector credit, to be published tomorrow. Credit should have expanded by 0.5% in October. Business credit growth has remained robust throughout the Delta lockdowns, partly reflecting a desire by businesses to shore up cashflow buffers. Business credit is expected to continue to expand, as the economy recovers following reopening across the largest states.

United States Outlook

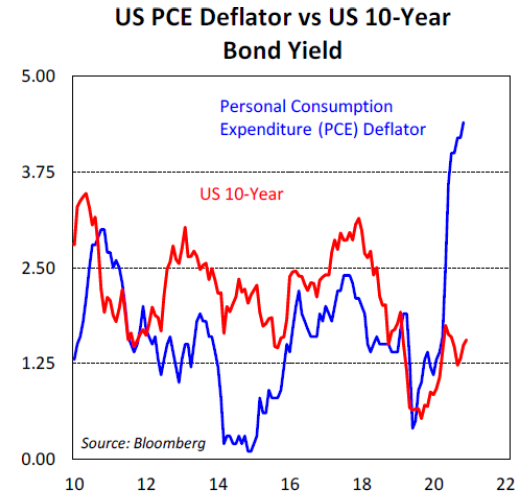

The continuing US economic recovery and rising inflationary pressures have led us to review our outlook for US monetary policy settings last week. The US economic recovery is back on track, following temporary impacts due to the spread of Delta.

Inflationary pressures have continued to increase more rapidly than previously anticipated by policy makers. In fact, annual inflation has risen to levels not seen for several decades. Some policy makers now consider inflationary pressures to be less transitory than previously thought.

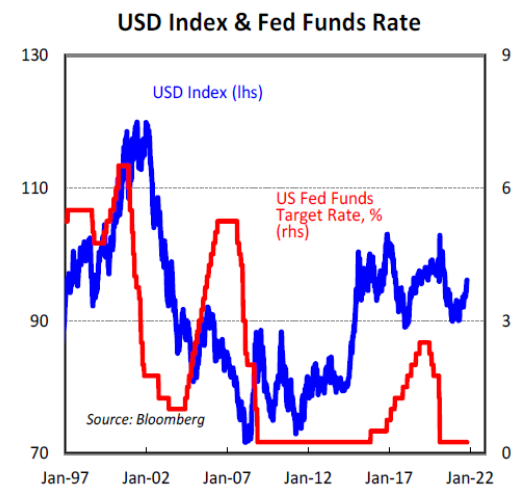

As a result, market expectations for the first rate hike from the US Federal Reserve (Fed) have been brought forward. Pricing for the first rate hike sits at August 2022. Prior to the Omicron outbreak, we forecast the Fed to hike rates three times over 2022, up from one rate hike previously. This tightening of monetary policy settings reflected our view that the Fed needs to act earlier than previously expected because inflation pressures appear to be more persistent than previously thought.

An earlier move on rates from the Fed will have important implications for the Australian dollar (AUD). We believe the Fed to have to do more than the Reserve Bank (RBA) and sooner, which means the AUD could face downward pressure over the first half of 2022. Interest rate markets are still pricing in around 3 rate hikes from the RBA over the second half of next year, which is too aggressive. It suggests there is some room for pricing to pull back and with it demand for the AUD in the first half of 2022.

We expect the USD index to peak around the middle of next year, so we are outlining a stronger trajectory for the AUD/USD over the second half of next year. The AUD/USD should also start to gather more momentum upwards as the timing of the first RBA rate hike nears; our forecasts are for the RBA to begin its rate-hike cycle in early 2023.

In periods of heightened volatility, technical analysis plays an important role. Fundamentally, the AUD/USD should be weaker over the next six months. But technically in the short term, much will depend on what happens at key support at around 0.7106, which represents the low during the Delta lockdowns.

Since the RBA met on November 2, the AUD/USD has trended lower from around 0.7535 to a 3 month low of 0.7113 on Friday night. However, the pace of selling appears to have eased over the last two trading sessions and the key support level of 0.7106 has stayed elusive. A clean, sustained break under this support would suggest a more bearish near term outlook for the AUD/USD. But if the AUD/USD can keep its head above this level, then the price action could still be consistent with consolidation for the AUD/USD since its rapid rise from 0.5510 on 19 March 2020 to 0.8007 on 25 February 2021.

Forecasting can often be an exercise in humility, and this is particularly true during the time of COVID-19. These forecasts presume that health and economic impacts from COVID-19 can continue to be effectively managed as vaccination rates increase. However, the Omicron variant poses new risks to the outlook. As developments continue to unfold over coming days and weeks, their potential implications for the economic outlook will be closely considered.

The information in this website and the links has been prepared for general information purposes only by our research partners and does not take into account your personal objectives, financial situation or needs. It is not intended to provide commercial, financial, investment, accounting, tax, or legal advice. You should, before you make any decision regarding any information, strategies, or products mentioned on this website, consult a professional financial advisor to consider whether it is suitable and appropriate for you and your personal needs and circumstances.

Ronald Pratap

Get in touch with us to develop your strategic plan and achieve peace of mind.

-

ABN: 34 612 655 142