2022 Federal Budget Analysis with RP Wealth Management

Written by Ronald Pratap

Last night, the Government handed down the 2022 Federal Budget. We’ve analyzed the Budget proposals, and you can see our findings and analysis below.

This year’s Federal Budget covers a range of measures aiming to reduce the pressure from increased costs of living and help more people into homes.

More detailed information around the key proposals are as follows:

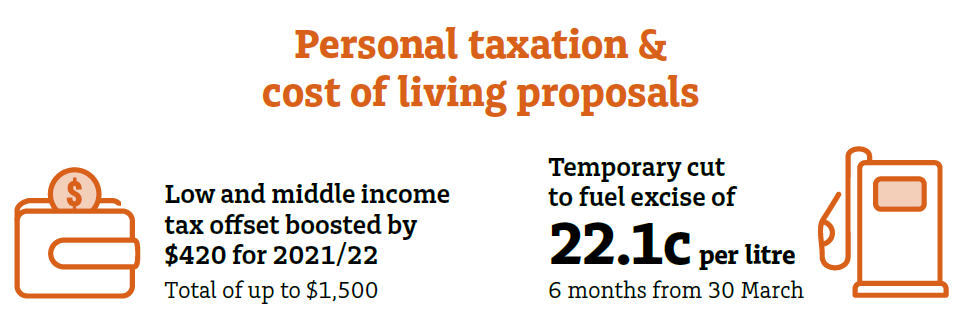

PERSONAL TAXATION

- Cost of living tax offset: The Low and Middle Income Tax Offset (LMITO) will increase, providing an additional $420 to reduce tax payable for eligible taxpayers in the 2021/22 financial year. This offset is non-refundable and available to those earning up to $126,000 per annum. However, individuals earning over $126,000 per annum will not benefit. Further, LMITO was not extended, meaning it will not apply for the 2022/23 or later financial years.

- Halving of fuel excise: For six months from 12:01am 30 March 2022, the excise on fuel and petroleum-based products will be halved. Whilst not a direct tax, the expectation is this should result in lower fuel prices during this period. Half the current excise on fuel and diesel is 22.1 cents per litre.

- Indexation of the Medicare Levy thresholds: The Medicare Levy low-income thresholds are indexed each year. From 1 July 2021, the thresholds are expected to be as follows:

- For singles $23,365 (increased from $23,226)

- For families $39,402 (increased from $39,167) plus $3,619 per dependent (increased from $3,597)

- For single seniors and pensioners $36,925 (increased from $36,705)

- For family seniors and pensioners $51,401 (increased from $51,094) plus $3,619 per dependent (increased from $3,597)

HOME OWNERSHIP

- Affordable housing measures: The First Home Loan Deposit Scheme and Family Home Guarantee allow eligible individuals to purchase a home with as little as a 2% deposit, and the Government will guarantee the loan, removing the need for lenders mortgage insurance. Currently, guarantees are limited to 10,000 per year. From 1 July 2022, changes to the existing home guarantee schemes will be made by allocating a total of 50,000 guarantees as follows:

- 35,000 places under the First Home Guarantee (formerly the First Home Loan Deposit Scheme)

- 5,000 places under the Family Home Guarantee targeting single parents regardless of any previous home ownership

- 10,000 places under a new Regional Home Guarantee targeting individuals who have not owned a home in five years who relocate to a regional location and can supply a 5% deposit.

The Family Home Guarantee and Regional Home Guarantee places are provided until 30 June 2025, whilst the 35,000 First Home Guarantee places are proposed to continue indefinitely.

BUSINESS TAXATION

- Small business training deductions: The Government is proposing to allow a deduction of 120% of eligible costs incurred in training staff in small businesses (ie businesses with an aggregated annual turnover less than $50 million). Generally, training must be delivered by an external registered training organisation in Australia and is only deductible if it relates to employees. For example, if an employer pays an external training company $5,000 to deliver eligible training to its employees, the employer can deduct $6,000 in its tax return. This measure is proposed to apply from 29 March 2022 to 30 June 2024.

- Small business technology deductions: Small businesses may be eligible to deduct up to 120% of eligible business costs which support the business adopting digital technologies, such as cloud services or cyber security systems. Eligible expenditure will be capped at $100,000 per financial year and the measure is expected to operate from 29 March 2022 to 30 June 2023.

- Changes to Pay As You Go (PAYG) instalments: The Government proposes to allow PAYG instalments for businesses to be calculated from approved software systems, based on current financial performance from 1 January 2024, subject to industry feedback. This aims to calculate more accurately withholding rather than having businesses wait until they have lodged a tax return to receive a refund of over-withheld amounts.

- Increase to JobTrainer: The Government has proposed an additional 15,000 places in their JobTrainer program, which provides free or subsidised vocational training in select industries such as aged care and disability support.

SUPERANNUATION

- Continuation of the reduced minimum pension drawdown: The budget proposes to extend the minimum amount that needs to be drawn from account-based income streams to the 2022/23 financial year. This means individuals with account-based pensions or term allocated pensions will be required to draw less from their savings, in line with the current year minimums.

SOCIAL SECURITY

- Cost of living payment: Eligible social security recipients resident in Australia will receive a one-off $250 payment in April 2022. Eligible payments include the Age Pension, Disability Support Pension, Carer Payment and Allowance, JobSeeker Payment (and equivalent DVA payments), as well as individuals holding a Pensioner Concession Card or Commonwealth Seniors Health Card. Like previous relief, the payments will not be means tested and will be tax-free. Individuals will only receive one payment even if they receive multiple qualifying benefits.

- Paid parental leave changes: Parental leave pay is proposed to be combined with Dad and Partner Pay resulting in a single scheme of up to 20 weeks leave which can be shared between parents as they see fit. This leave can be taken at any time within two years of birth or adoption. The new payment is proposed to be subject to an additional household income test designed to increase eligibility. Single parents are also expected to be able to access an additional two weeks of leave.

- Lowering the Pharmaceutical Benefits Scheme (PBS) safety net: From 1 July 2022, the Government proposes the PBS safety net to come into effect earlier, with 12 fewer scripts being required for concessional patients and 2 fewer scripts for general patients each calendar year before the safety net activates. Once within the safety net, concessional patients do not pay for PBS medicines whilst general patients only pay the concessional co-payment rate (currently $6.80 per script).

The information in this website and the links has been prepared for general information purposes only by our research partners and does not take into account your personal objectives, financial situation or needs. It is not intended to provide commercial, financial, investment, accounting, tax, or legal advice. You should, before you make any decision regarding any information, strategies, or products mentioned on this website, consult a professional financial advisor to consider whether it is suitable and appropriate for you and your personal needs and circumstances.

Ronald Pratap

Get in touch with us to develop your strategic plan and achieve peace of mind.

-

ABN: 34 612 655 142