Setting yourself up for a successful 2024

Written by Ronald Pratap

When you look back on 2023 in ten years, you may remember how expensive everything became, from petrol to electricity to groceries and essentials

That is why we must set yourself up for a successful 2024 and ensure you are positioned as best as possible financially.

Yes, some price increases will be difficult to avoid, but if you’re proactive and spend some time handling a different item each day for the next week, I believe you’ll be set up for better budgeting this year.

What is the best part? You may handle the majority of these charges by conducting a quick comparison, sending an email, or making a phone call. They’re so simple that you can complete several of them on the commute to work or between commercials on television or just taking a day to get it all sorted.

Fight back against price increases

We’re all used to rising prices, but being complacent won’t help you. According to the Compare the Market survey, 72.1% of Australians have not switched energy plans in more than a year. That’s unexpected given that average costs for families on so-called “standing offers” in New South Wales rose by between $315 and $435 in July.

There are often considerably better deals on the market for those who are prepared to look for them or simply calling up your provider and seeing what options are available. The savings increase as you tackle more expenses. After you’ve evaluated energy plans, go on to your insurance options.

When comparing auto insurance premiums in December, a Victorian couple with a 2019 Volkswagen Tiguan saved $762.

Supercharge your super

Most employers now offer salary sacrificing, which allows you to contribute up to $27,500 of your pre-tax income to your superannuation.

Any contributions you make will be taxed at 15% unless you are making over $250,000, which is likely to be significantly lower than your marginal tax rate.

Make your money work harder

Interest rates are rising, therefore we can’t afford to let our hard-earned money dwindle. This might include paying off any high-interest obligations, putting your money in a term deposit, or holding it in an offset account to lower your mortgage interest rate.

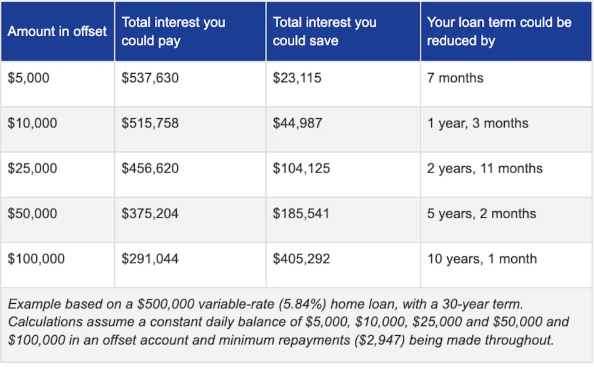

Compare the Market ran the figures and discovered that putting just $25,000 in an offset account for a $500,000 loan with a 5.84 percent interest rate may shorten your loan term by two years and 11 months while saving you more than $100,000 in interest over the life of the loan.

(Source: Supplied)

Do away with upgrades

We’ve all been drawn into the competition to own the latest and best gadgets. When your phone plan expires, ask yourself, ‘Do I really need a new phone?’

Sticking with an old handset and switching to a lower-cost phone plan might save you hundreds of dollars annually.

For example, retaining your old phone and selecting a basic $30 data plan rather than purchasing a new phone with a $70 data-and-payment plan will save you $480 over the course of a year.

Find the hidden rewards

Major supermarkets allow you to “boost” your points within applications, increasing the number of points that may be redeemed for store credit.

Meanwhile, insurers and energy providers frequently offer unique deals and discounts to entice members.

Having Woolworths Everyday Car Insurance, for example, saves you 10% on one supermarket shop per month. If you use the discount on a $160 food shop every month, you’ll save $192 over the course of the year.

Fuel for thought

Use fuel-comparison websites to discover cheaper gas on your commute to work or dropping the kids off at school. There might be significant differences between fuel stations at different stages of the fuel cycle.

One client saved $291.88 over a year by utilising the Simples App to find lower-cost options.

That money you save could be enough to fund your next car service, or used to put onto the mortgage or offset which will further reduce your loan term and the interest you pay.

I hope some of these strategies help you save smarter this year, allowing you to meet your financial objectives and increase your budget for the things that are truly important.

The information in this website and the links has been prepared for general information purposes only and does not take into account your personal objectives, financial situation or needs. It is not intended to provide commercial, financial, investment, accounting, tax or legal advice. You should, before you make any decision regarding any information, strategies, or products mentioned on this website, consult a professional financial advisor or seek assistance to consider whether it is suitable and appropriate for you and your personal needs and circumstances.

Ronald Pratap

Get in touch with us to develop your strategic plan and achieve peace of mind.

-

ABN: 34 612 655 142