Foundations of a wealthy lifestyle

Written by Ronald Pratap

Building foundations for a wealthy lifestyle can come back to the basics and we explore what you can do with your personal situation to make that happen.

A study conducted by the Australian Stock Exchange(ASX) reported that nearly 25% of investors over the past two years were aged 18 to 24.

These young Australians were found to be knowledge seekers, keen to take on life and begin their journey towards financial security and invest for their future.

If this describes you, congratulations! You get it, you really do. You’re Next Generation Investors who know that building financial independence starts early and creating good habits that will last you for a lifetime.

However, according to the same study, Next Generation Investors, aware of their inexperience, are uncomfortable making financial decisions and are unsure how to build the right starting foundations.

If this is also you, here are our tips for laying the foundations for a wealthy and successful future!

Avoid unnecessary debt

If there’s one thing guaranteed to keep you awake at night it’s debt. Naturally, some debt can’t be avoided and is considered ‘good’ debt, like when you borrow to buy a house or that debt works for you building wealth.

But ‘bad’ debt is sometimes unnecessary and often comes with high interest and is best avoided where possible. You know we’re talking about credit cards, personal loans for holidays, Buy-now-pay-later services right?

Credit cards can fast-track you into debt-strife, particularly as tap-and-go transactions are just so quick and so easy to use these days.

Additionally, while those buy-now-pay-later schemes can be useful for emergencies if, say, your fridge packs up, they’re a trap if you don’t stay in control and continue funding expenses this way.

Sure, online shopping and bill-paying means using cards but you can avoid using credit or be practical about when to pay this off at the end of every month.

Functioning the same as credit cards, debit cards use your money instead of the bank’s. They can be linked to your bank account, or loaded with cash which is handy for keeping track of your spending, as you can only spend as much as you’ve loaded so you avoid paying unnecessary interest.

If you do end up with debt, be accountable. Pretending it’s not there won’t make it go away. Further, unpaid bills can grow through late fees and penalties.

Read the fine print on contracts and understand what you’ve signed up for. Late payments and loan defaults can result in legal action, even bankruptcy, destroying your credit rating for years!

Pay down debt as soon as you can by:

- making additional payments where possible.

- paying above the minimum monthly amount.

- consolidating debts, and negotiating a better deal.

- prioritising debts with the highest interest rate and smaller balance to hit goals along the way and reduce the number of debt accounts you have.

Track spending

On the topic of spending, get into the habit of tracking yours. Using a simple spreadsheet, or an app from your bank, log your purchases and reconcile spending with receipts. You can start by using a simple budgeting spreadsheet from Moneysmart

You’ll see exactly where your money is going and spot any areas of unnecessary spending, like those items you really don’t need but are the coolest ‘must-haves’.

Don’t fall for it; ‘must-have’ is a marketing term. True must-haves are basics like food, shelter, transport and medical – not the latest trends and gadgets.

We’re not saying don’t treat yourself occasionally, but to pause and consider whether the item is really worth burdening yourself with. Check your monthly debits and if you are still using these services eg. old gym membership, streaming services, online subscriptions.

Superannuation

Think you’re too young to worry about superannuation? Prefer to put your money toward something for now rather than later?

You may be right, but don’t dismiss super altogether. Here are some things you can do that won’t impact your current finances:

- Ensure your employer is contributing the correct amount of super. If you are earning more than $450, pre-tax in any calendar month, your employer must contribute 10% to a super fund on your behalf. These contributions are Superannuation Guarantee Contributions (SGC) and they are compulsory.

- Low-income earners may qualify for Government Co-contributions where the government contributes up to $500 to your super fund. When you lodge your tax return, your eligibility is automatically assessed, and if you qualify the government deposits directly into your super account.

- Put unforeseen cash into super. Sure, you’re locking it away, but it’s money you weren’t expecting anyway! The longer it’s in super, the more it can potentially grow while reducing your tax liability depending on how you contribute these funds. Any additional payments can also help fund your fees and insurance premiums being deducted from your balance.

Save Vs Spend

You’re entitled to live, and you’re entitled to a social life. We’re not saying save or spend, we’re suggesting you can do a bit of both. Laying good foundations for your future, also means creating the right habits.

This is how it works:

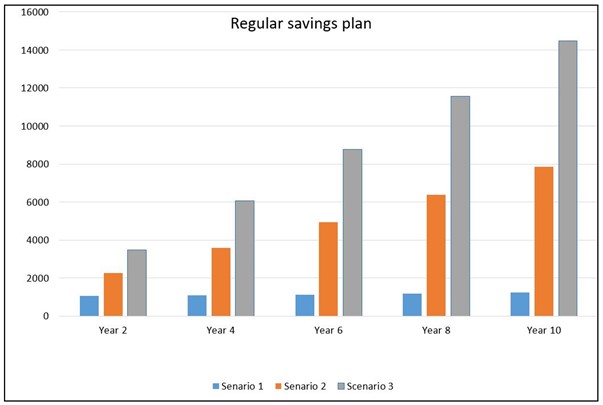

| Scenario 1 | Scenario 2 | Scenario 3 | |

| Initial Deposit | $1,000 | $1,000 | $1,000 |

| Interest Rate | 2% PA | 2% PA | 2% PA |

| Regular Deposit | N/A | $50 per month | $100 per month |

The chart below shows the result of the above scenarios after ten years.

Each scenario is based on a $1,000 initial deposit with 2% PA interest calculated monthly. In Scenario 1 no further deposits are made. Scenario 2: shows $50 monthly deposits, and Scenario 3: $100 monthly deposits.

Adjust the figures to suit your personal budget and commit to saving a small amount each pay while still enjoying a life. Have the amount automatically deducted from your account and soon you won’t even miss it! There are also some great micro-investment apps out there where you can accelerate the growth of your funds by allocating a portion to investment markets depending on how comfortable you are.

Regular savings accounts and micro investing apps are available from banks and other financial institutions, and offer a variety of arrangements. For example:

- Your initial deposit can be as little as $50.

- Some pay bonus interest if no withdrawals are made in a month.

- Some offer higher interest for 18 – 24 year old’s.

- You can choose your risk profile from conservative to high growth

Do your research, particularly websites providing independent product comparisons.

Seek advice

A professional financial planner can tailor a plan specifically for you. They will consider your debt, income, goals and much more, and work with you to structure a strategy for now while laying the right foundations, and incorporate the future – you may even be surprised at how inexpensive good advice can be.

So, there you are! The future is laid before you and it’s loaded with potential; all you need to do now is get on with it set the right foundations. You can contact us at our Oran Park office. We also now have an office in Baulkham Hills as well as servicing Macarthur, Penrith, Campbelltown, Parramatta, Blue Mountains, Silverdale, Fairfield, and Greater Western Sydney.

The information in this website and the links has been prepared for general information purposes only and does not take into account your personal objectives, financial situation or needs. It is not intended to provide commercial, financial, investment, accounting, tax or legal advice. You should, before you make any decision regarding any information, strategies, or products mentioned on this website, consult a professional financial advisor or seek assistance to consider whether it is suitable and appropriate for you and your personal needs and circumstances.

If you like this article about setting up good foundations, you may also like:

Ronald Pratap

Get in touch with us to develop your strategic plan and achieve peace of mind.

-

ABN: 34 612 655 142